A substantive push to expand legal gambling in Ohio is in progress. Two main bills have been introduced and remain in the early stages. They share a common goal of establishing a firm launch deadline of March 31, 2026, for iGaming.

HB 298 is a comprehensive online casino bill seeking to regulate and legalize internet gambling. It also includes a specific provision to ban sweepstakes casinos. SB 197 also seeks expansion to include casino gaming, adding online lottery and horse racing betting to the list.

The optimistic scenario is passage by the House and Senate, followed by the governor signing it into law. As is always the case when there’s a push for gambling legalization or expansion, there remains much to sort out before that can become a reality.

Ohio social and sweepstakes casinos

Real-money online casinos are not available in Ohio and won’t be unless the state passes a gambling expansion bill and the governor signs it into law. Those who are looking for online play have an alternative in the form of social and sweepstakes casinos. On these sites and apps, you can experience the fun and entertainment aspect and even win real prizes. Here are our four most trusted options.

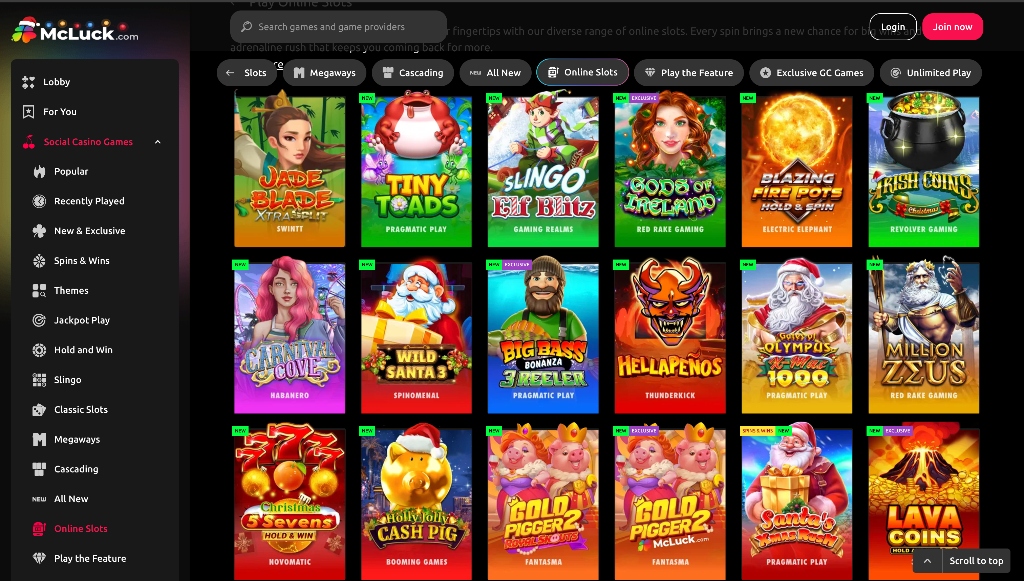

McLuck Casino

McLuck Casino is one of the most popular destinations for sweepstakes players across the US, featuring a massive library of 1,492 games. New customers can be off and running with a welcome bonus when they sign up, and there’s also a daily login reward to help you keep playing.

| 🎁 Welcome bonus: | New users receive 7,500 Gold Coins and 2.5 Sweeps Coins at registration. No purchase required. |

| 🎰 Game highlights: | Massive menu of slot games, including Buffalo King Megaways, Lucky Emeralds, and Sweet Bonanza. |

| 🏧 Redemption: | You can redeem SC winnings for real money prizes, with a minimum redemption of $75. |

| 📍Availability: | McLuck Casino is available to play in Ohio. |

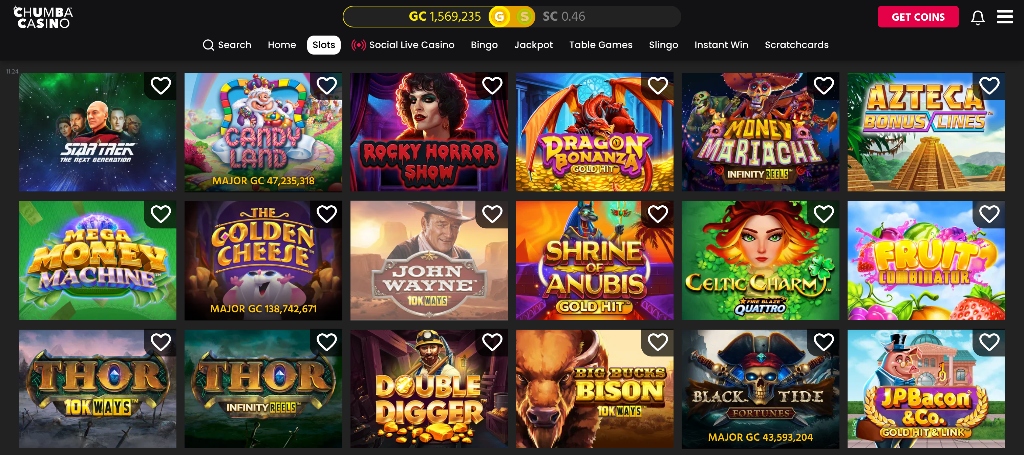

Chumba Casino

Chumba Casino is an established player in the social casino space. You can choose from a variety of games, including slot titles like Zombie Circus, and table games such as blackjack. There are regular ways to earn more coins as you play, including featured contests that drop on social media platforms like Facebook and Instagram.

| 🎁 Welcome bonus: | New users receive 2M FREE Gold Coins and 2 FREE Sweeps Coins at registration. No purchase required. |

| 🎰 Game highlights: | Featuring 200+ titles from top developers like Pragmatic Play and NetEnt. Great selection of slots, jackpots, instant win, and more. |

| 🏧 Redemption: | You can redeem Sweeps Coin winnings for real money prizes, with a minimum redemption of $100. |

| 📍 Availability: | Chumba Casino is accessible in Ohio. |

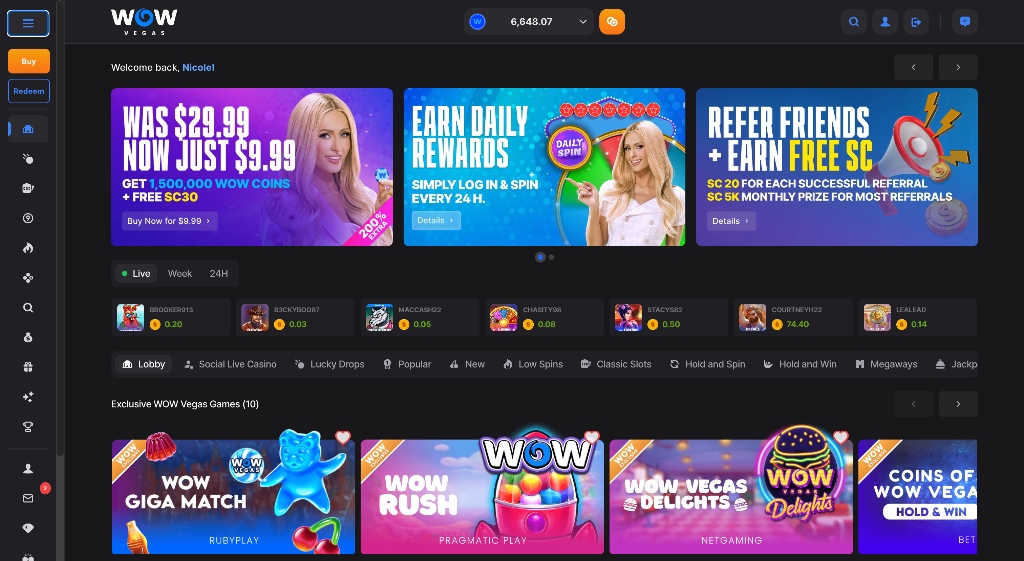

WOW Vegas Casino

WOW Vegas has surged up the charts and quickly become one of the top sweepstakes sites in many parts of the US. A massive game library has certainly helped, as has a VIP program where you can earn more coins as you climb levels. After you sign up and claim the welcome offer, you can dive in and check out featured games like WOW Vegas Elvis Frog Trueways.

| 🎁 Welcome bonus: | New users receive 250,000 WOW Coins and 5 Sweepstakes Coins at registration. No purchase required. |

| 🎰 Game highlights: | Slots, roulette, table games, jackpots, and more from top providers like BetSoft and RubyPlay. |

| 🏧 Redemption: | You can redeem SC winnings for real money prizes, with a minimum redemption of $25. |

| 📍 Availability: | WOW Vegas casino is available to play in Ohio. |

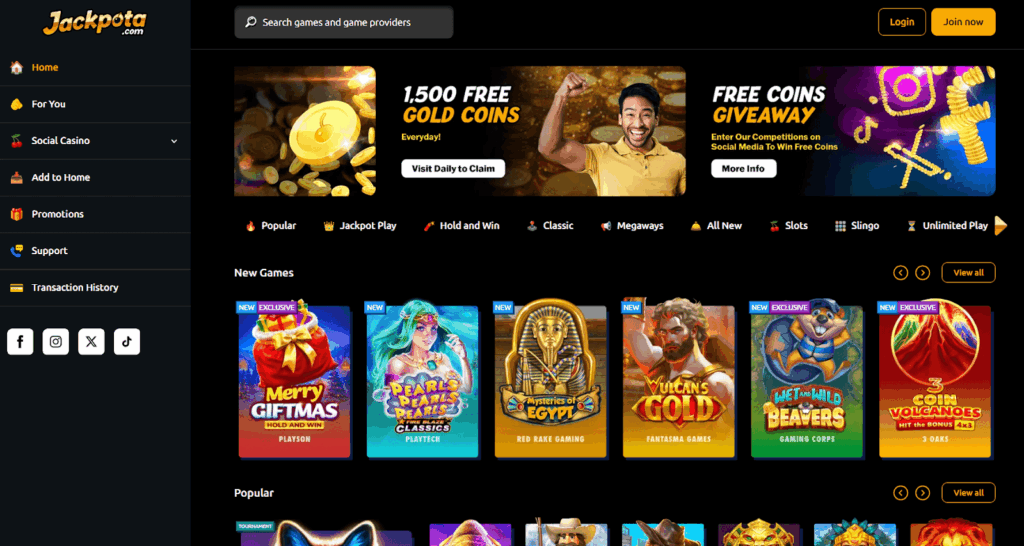

Jackpota Casino

Jackpota Casino delivers a smooth experience for sweepstakes players. It offers hundreds of slot games to try out, along with several Slingo titles if you’re looking to mix things up. You get free coins to play with once you register, and there are several ways to add to your stack along the way. For additional fun, check out the “Jackpot Play” tab and try for a big score.

| 🎁 Welcome bonus: | New users receive 7,500 GC + 2.5 SC at registration. No purchase required. |

| 🎰 Game highlights: | Features hundreds of slot titles, including Gates of Olympus, Candy Corner, and many more. |

| 🏧 Redemption: | You can redeem SC winnings for real money prizes, with a minimum redemption of $75. |

| 📍 Availability: | Jackpot Casino is accessible in Ohio. |

Current status of Ohio gambling bills

Gambling options have steadily expanded in Ohio over the past 10+ years. Brick-and-mortar casinos and racinos debuted in 2012. And 2023 saw the highly anticipated launch of legal sports betting, both online and in person.

The legalization of online casino gaming remains a work in progress, with two bills aiming to do just that in hopes of a launch in 2026. The last attempt, SB 212, came up short in 2024. The bill would have allowed each of the state’s 11 casinos to launch and operate one online casino platform.

Following its introduction, the bill went to the Senate Finance Committee. It did not receive a hearing and died with the conclusion of the 2024 legislative session. The bill’s sponsor, State Sen. Niraj Antani, left office. He made an unsuccessful bid in the Republican primary for a seat in the US House of Representatives.

Sen. Nathan Manning and Rep. Brian Stewart have picked up the mantle in 2025. Manning is a sponsor of SB 197, an effort to legalize online casino gambling, internet lottery gaming, and online pari-mutuel wagering for horse racing. HB 298, sponsored by Stewart, looks to legalize and regulate internet gambling while also banning online sweepstakes games.

Top advocates of the bill include industry stakeholders and heavyweights, including MGM and Caesars. At the legislative level, supporters point to a legal and regulated framework as a means of limiting and eliminating illegal gambling, as well as the potential for substantial tax revenue for state coffers.

Opponents include retail casino operator JACK Entertainment, which has expressed worries about the potential cannibalization of its business and the impact that would have on local jobs. The Fair Gaming Coalition of Ohio has similar fears about the potential impact on small businesses. In the legislature, detractors opposing expansion include Sen. Al Landis and Sen. William DeMora.

SB 197 and HB 298 are still at the committee level, but debates and hearings have taken place. If the bills survive the committee round, the next step is a floor debate and vote. Successful passage in both chambers would send the bill to the desk of Gov. Mike DeWine, who could then veto or sign the bill into law.

How social and sweepstakes casinos work

A sweepstake casino lets users experience casino games for free. They’re available across much of the US, including in states such as Ohio that have yet to legalize iGaming. Users can play sweepstakes games using either a for-fun currency (which many sweepstakes casinos call Gold Coins) or a premium currency that allows you to redeem winnings for prizes (often called Sweepstakes Coins or Sweeps Coins, depending on the site).

Many of the top sites provide you with some of these virtual coins for signing up and also provide opportunities to accrue more as you continue playing. You can redeem SC for gift cards and real money prizes once you have met the balance and playthrough requirements.

Ohio Senate Bill 197

Ohio SB 197 was introduced by Sen. Nathan Manning on May 13, 2025. The bill’s ultimate goal is “to legalize internet gambling and levy a tax on businesses that provide internet gambling, to permit internet lottery gaming and online wagering on horse racing, to make other changes to the gambling law, and to make an appropriation.”

In addition to introducing three new types of internet gaming, the bill would consolidate and amend some of the state’s existing rules and regulations, such as placing all oversight of the state’s gambling under the Ohio Casino Control Commission. On internet gambling expansion, here are the key takeaways:

- The bill would allow licensed internet gambling operators to offer internet gambling in Ohio, as regulated by the Ohio Casino Control Commission under similar terms as for online sports gaming.

- It would require the commission to designate a launch date for internet gambling that is no later than March 31, 2026, and would allow it to issue provisional licenses for the first six months.

- It would define internet gambling games to include games with virtual representations of spinning reels or wheels, cards, dice, tiles, or other equipment, with the outcome of the game being determined randomly.

- And the bill would allow only an Ohio casino operator or horse racetrack owner to be licensed as an internet gambling operator, with each operator having a limit of one internet gambling platform.

The bill calls for an initial license fee of $50 million and a renewal fee of $5 million. It makes a specific note that operators can contract with an internet gambling management company to operate the internet gambling platform, with the following caveat:

- If the same person does not own or control at least 50% of both the operator and the management company, the management company must pay a fee of $50 million for an initial license and $5 million for a renewed license.

SB 197 proposes levying an online gambling tax rate of 36%. If the operator contracts with a management company and the same person does not own or control at least 50% of both the operator and the management company, the rate would rise to 40%. The bill was forwarded to the Select Committee on Gaming on May 14.

Ohio House Bill 298

Ohio HB 298 was introduced on May 20, 2025. It covers some of the same territory as the Senate bill but also aims for a specific prohibition. The bill’s ultimate goal is “to legalize and regulate internet gambling in this state, to levy a tax on businesses that provide internet gambling, and to prohibit online sweepstakes games.”

References to who can offer internet gambling in the state, the proposed designated launch date, the definition of internet gambling, and contracting with an outside operator share the same language as SB 197. The biggest differences involve licensing fees, the proposed tax rate, and the focus on banning sweepstakes games. Here are the key points:

- HB 298 would require an operator to pay a license application fee set by rule, a license fee of $50 million for an initial license and $10 million for a license renewal.

- It would levy a 28% tax rate on online gambling platforms.

- And it would expand the criminal offense of gambling to include conducting, or participating in the conduct of, a sweepstakes in the form of an online sweepstakes game.

The bill goes on to define the online sweepstakes games that it’s seeking to ban:

- It is available online or through an app, computer terminal, or other similar device.

- It utilizes a dual-currency system of payment that allows a player to exchange the currency (1) for a cash prize, cash award, or cash equivalent, or (2) for a chance to win a cash prize, cash award, or cash equivalent.

- It simulates a gambling game.

- It is not a form of gambling expressly permitted by law.

HB 298 was referred to the House Finance Committee on May 21. If both bills advance, it’s possible they’ll be combined and lawmakers will seek common ground on licensing fees, tax rates, and the matter of online sweepstakes games.

Key facts and figures

| Population | 11.88 million (2024) |

| Online casino bills | SB 197 (Manning): To legalize internet gambling and levy a tax on businesses that provide internet gambling, to permit internet lottery gaming and online wagering on horse racing, to make other changes to the gambling law, and to make an appropriation. HB 298 (Stewart, John): To legalize and regulate internet gambling in this state, to levy a tax on businesses that provide internet gambling, and to prohibit online sweepstakes games. |

| Sweepstakes bill | HB 298, sponsored by Rep. Brian Stewart and Rep. Marilyn John, includes specific language to prohibit online sweepstakes games. |

| Online poker bill | Bill analysis for SB 197: “Defines internet gambling games to include games with virtual representations of spinning reels or wheels, cards, dice, tiles, or other equipment, with the outcome of the game being determined randomly.”The bill analysis for HB 298 includes the same definition and language. |

| What’s currently legal? | Casino gaming at four commercial casinos.Racinos offer horse racing betting and video lottery terminals.Sports betting, both in-person and online.Ohio Lottery games and keno.Horse racing at racetracks and licensed off-track betting facilities.Charitable gaming, including bingo and raffles. |

| Licenses and skins: Sports betting | There are 25 Type A licenses, intended for casinos and professional sports organizations, each of which permits one online skin. Qualifying entities can apply for a second skin if an economic need is demonstrated.Fourteen sportsbook apps are currently active. Type B and C licenses are for in-person wagering. |

| Licensing fees: Sports betting | Initial licensing fee for Type A licenses can range from $500,000 to $2.5 million.Renewal fees range from $125,000 to $625,000 annually for four years. Ohio Casino Control Commission fees depend on entity type and the number of mobile management providers. |

| Tax rate: Sports betting | Currently 20% for online and retail sports betting. It was initially 10% at launch in 2023. To date, additional attempts to further increase the rate have fallen short. |

| Licenses and skins: Online casino | Proposed: SB 197: Would allow only an Ohio casino operator or horse racetrack owner to be licensed as an internet gambling operator, with each operator being limited to one internet gambling platform.HB 298: Includes the same phrasing and adds the following: “Specifies that if two or more companies that would be eligible to be an internet gambling operator are controlled by the same parent company, only one of those companies may be an internet gambling operator.”11: There are four casinos and seven racinos in Ohio. |

| Licensing fees: Online casino | Proposed: SB 197: Would require an operator to pay a license application fee set by rule, a license fee of $50 million for an initial license and $5 million for a license renewal. Would specify that, if the same person does not own or control at least 50% of both the operator and the management company, the management company must pay a fee of $50 million for an initial license and $5 million for a renewed license.HB 298: Would require an operator to pay a license application fee set by rule, a license fee of $50 million for an initial license and $10 million for a license renewal. |

| Tax rate: Online casino | Proposed: SB 197: Would levy a tax on an operator’s internet gambling receipts at the following applicable rate: 36%. Or 40%, if the operator contracts with a management company and the same person does not own or control at least 50% of both the operator and the management company.HB 298: Would levy a 28% tax on an operator’s internet gambling receipts. |

Steps required to pass the bills

The 136th General Assembly for the Ohio Legislature is in progress. The term began in early January 2025, with the session expected to adjourn on or before Dec. 31, 2026. While that suggests plenty of time to hammer out online casino legislation, many steps remain. This is especially true if lawmakers wish to meet a potential March 31, 2026, launch date.

For that to happen, the bills would have to continue through the hearing stage and advance to a committee vote. Approval at that stage would move them along to the full chamber. Members can debate and propose further amendments before either bill passes to a vote. If a majority approves, it’s over to the other chamber for the same process.

At the second chamber stage, it ideally goes from the committee stage through hearings, amendments, and votes without roadblocks. If there turns out to be any differences between the House and Senate versions, a conference committee handles reconciliation and produces a final version of the bill.

The reconciled bill then heads to final passage, where both chambers must approve it. If that happens, the bill goes to the governor, who can sign it or veto it. If it’s a veto, Ohio law states that the legislature can override it with a three-fifths majority in both chambers. If the bill becomes law, it’s then a mad sprint of regulations and licensing to the launch date.

Major supporters of Ohio gambling expansion

Common themes among supporters of Ohio gambling expansion efforts include an influx of tax revenue, additional job creation, and a deterrence for illegal gambling activity that’s taking place. Here are some of the top advocates:

Supporter 1: Casino and sports betting operators

Top online gambling companies, including MGM Resorts, Caesars, and FanDuel, are among the leading advocates for expansion. Naturally, they stand to benefit, but they also tout the potential for substantial tax revenue.

Supporter 2: Select Ohio lawmakers

Several lawmakers, including the sponsors of the two bills, are pushing to bring legal online casino gaming across the goal line in Ohio. Many argue that the tax revenue boost outweighs any potential downside, while pointing to the expansion of choice for consumers.

Supporter 3: Sports betting alliance

The industry trade group, which counts BetMGM, DraftKings, FanDuel, and Fanatics among its members, is pushing for regulation. As they see it, online casino gambling is already happening on an illegal basis, and expansion would bring it under the legal umbrella and lead to more transparency and protection.

Major opponents of Ohio gambling expansion

The major opponents of Ohio gambling expansion hope to stymie efforts and keep the status quo. Many arguments center around the potential impact on local businesses and the possibility of social and economic harm. Here are some of the most vocal detractors:

Opponent 1: JACK Entertainment

The owner and operator of JACK Cleveland Casino and JACK Thistledown Racino is concerned that expansion would cannibalize local businesses and jobs, and is also pushing for the state to reserve online licenses for current land-based operators in Ohio.

Opponent 2: National Association Against iGaming

The NAAiG describes itself as “a coalition of local businesses, industry veterans, community advocates and concerned citizens united to safeguard our communities from the harmful impacts of online gambling.” The group focuses on economic and societal impacts from iGaming legalization.

Opponent 3: Select Ohio Legislators

Sen. Al Landis and Sen. William DeMora are among the Ohio legislators opposed to expansion. Landis advocates for maintaining the current environment, while DeMora has cited concerns about the potential impacts on local businesses and the state horse racing industry.

Expected revenue impact from online casinos in Ohio

Released in July 2024, the Report of the Study Commission on the Future of Gaming in Ohio provides a comprehensive forecast of what could happen. There are multiple estimates sprinkled throughout the 354-page document.

- According to the Legislative Service Commission, similar gross revenues taxed at the same rate as casinos would generate $500 million to 650 million in annual tax revenue for the state of Ohio. (Page 15, letter from Rep. Rose Sweeney)

- Ohio could generate between $205 million to $410 million per year in new tax revenue from legalized iGaming. (Page 77, estimate from the Sports Betting Alliance)

- An economic study conducted by Vixio in collaboration with Light & Wonder determined that iGaming would produce $255 million in annual tax revenue to the state of Ohio. (Page 124, submitted testimony from the iDevelopment and Economic Association)

Estimates range from a low of $205 million to a high of $600 million annually. For comparison, 2024 was the second full year of legal sports betting in Ohio. A full-year sports gaming revenue report from the Ohio Casino Control Commission tallied total taxable revenue of $904,187,897.

If we apply the 20% sports betting tax rate, that translates into $180.8 million in tax revenue for the state. Study estimates suggest that casino tax revenue could beat that handily, and potentially double or triple that amount.

Ohio gambling legislation: Past bills and history

On Nov. 3, 2009, Ohio voters passed State Issue 3, a proposed constitutional amendment to allow one casino each in Cincinnati, Cleveland, Columbus, and Toledo, and distribute to all Ohio counties a tax on the casinos.

That was the green light for casinos and racinos in the state, the first of which opened in 2012. It was quiet on the legislative front for several years thereafter, but the mood began to shift in May 2018 when the US Supreme Court overturned PASPA.

That ruling placed the matter of sports betting legalization into the hands of individual states. Many quickly took the ball and launched retail and online sportsbooks. It took time for things to get moving in Ohio, with the launch not happening until 2023.

Sports betting legalization of at least some kind has happened in a majority of US states, standing at 38 states plus Washington, DC, to date. Legal online casino gaming has proceeded at a much slower pace and is currently available in just seven states.

Here’s a timeline of the legislative efforts that brought Ohio sports betting to fruition, plus a previous attempt that failed to make online casino gambling a reality in the state.

- SB 176

- Primary Sponsors: Antani, Manning

- Summary: To legalize and regulate sports gaming in this state, to levy a tax on businesses that provide sports gaming, and to make other changes to the gambling law.

- Introduced: May 6, 2021

- Result: Passed Senate on June 16, 2021. Stalled in the House, with language merged into HB 29.

- HB 29

- Primary Sponsors: Wiggam, Miller

- Summary: Legalized sports betting (retail, online, kiosks). Set Jan. 1, 2023, as the launch date.

- Introduced: February 3, 2021.

- Result: Passed House and Senate on Dec. 8, 2021. Signed by Gov. DeWine on Dec. 22, 2021.

- SB 312

- Primary Sponsor: Antani

- Summary: Legalize and regulate internet casino gaming; levy a tax.

- Introduced September 2024.

- Result: Referred to committee on Nov. 12, 2024. Did not advance.