Robinhood’s prediction markets platform lets users trade contracts on real-world events like sports outcomes and economic figures. Top features include the ability to trade live as events unfold, low and transparent contract fees, and instant settlement after event resolution.

It operates legally in the US through a partnership with Kalshi, which is regulated by the Commodity Futures Trading Commission, but state restrictions may apply. For example, the platform has pulled sports contracts in Maryland, New Jersey, and Nevada, but economic events are available in those states.

In this comprehensive review of Robinhood prediction markets, we explain how the platform works and where you can find the best value. We also check what traders are saying to provide you with a complete picture of contract trading at Robinhood.

📌 Robinhood quick facts

| 🔎 Key feature | 📋 Details |

|---|---|

| 💰 Robinhood promo code | Not available |

| ✅ Best feature | CFTC-regulated prediction markets hub for event contracts that’s accessible to US retail investors. |

| 🛡 Regulator | Commodity Futures Trading Commission |

| 🇺🇸 Available states | All 50 US states (sports contracts currently not available in MD, NJ, and NV). |

| 🏧 Minimum deposit | No required minimum to open an account; $1 minimum to place a real-money trade. |

| ⏱ Cashout speed | Proceeds are credited instantly to your balance after contract settlement. Standard ACH withdrawals typically take one to three business days (up to five max, free). Instant withdrawal processes in minutes (1.75% fee applies; $1 minimum, $150 maximum). |

| 📲 Mobile app | Available on iOS and Android |

| 📈 Liquidity | Current most liquid markets: Sports, including the NBA playoffs and NHL Stanley Cup playoffs. Economics, such as Federal Reserve interest rate decisions. |

| 💸 Fees | $0.02 per contract traded: $0.01 commission to Robinhood, $0.01 exchange fee to Kalshi. |

Pros and cons

- CFTC-regulated: Event contracts are offered by Robinhood Derivatives and its partnership with Kalshi, both of which are regulated by the CFTC.

- Availability: Robinhood prediction market contracts are available for trading in all 50 states. However, sports contracts are not available in MD, NJ, and NV.

- Trading options: You can trade prediction markets and other financial products on one platform, reducing the need for multiple accounts.

- Transparent fees: You’ll pay $0.02 per contract when trading at Robinhood. No fees on standard withdrawals, but a 1.75% fee applies if you request instant processing.

- App only: You can only access prediction market trading via the Robinhood app, leaving those who prefer to trade on larger screens out of luck.

- Limited markets: While there are plans to expand offerings, prediction market contracts are limited to sports and economics for now. Additionally, there’s currently no way to view contract volume traded or the number of positions by price point.

- Accessibility: You must apply for and have an approved Robinhood Derivatives account to trade event contracts. To be eligible for such an account, you must have an open individual account with margin trading enabled or options trading approved.

- Regulatory concerns: Sports event contracts are unavailable in MD, NJ, and NV, while other states have issued cease and desist letters while questioning the platform’s overall legality.

📘 What is Robinhood, and is Robinhood legal?

Robinhood is a financial services company based in the US. The company was founded by Vlad Tenev and Baiju Bhatt in 2013. Since its debut, the company has seen extraordinary growth while working toward its mission of making financial markets accessible to everyone.

Part of Robinhood’s rise to prominence can be tied to its commission-free approach. Users can buy and sell ETFs, stocks, and options without commissions, but regulatory fees may apply. Additional highlights include a smooth and intuitive platform that’s designed for ease of use on mobile, plus trading availability for multiple cryptocurrencies.

Robinhood has expanded to international markets and is now firmly regarded as a leading online broker. For 2024, the company reported $193 billion in assets under custody and 25.2 million funded customers.

🚪 Robinhood enters prediction markets

The company entered the prediction market space in October 2024, offering presidential election event contracts through its subsidiary, Robinhood Derivatives, LLC. These contracts allowed users to trade on the outcome of the 2024 US presidential election.

It marked a major step into event-based trading and was a smash hit, with more than 500 million election contracts traded just a week after launching. Following that success, the company expanded its offerings in 2025 with Super Bowl-related contracts via a partnership with Kashi.

Robinhood’s move into prediction markets has not been all smooth sailing. In early February 2025, the company pulled those contracts at the request of the CFTC, which has been embroiled in ongoing proceedings with Kalshi that have yet to be resolved.

The company didn’t remain sidelined from sports for too long. Its prediction markets hub officially launched on March 17, 2025, just in time for March Madness. Offerings have since expanded to include economic indicators, such as the US federal funds rate, and markets for the NBA, NHL, and PGA.

Individual states have pushed back on the offering of prediction markets. To date, Robinhood has pulled sports event contracts in Maryland, New Jersey, and Nevada, while also handling inquiries from regulators in other states, including Illinois and Ohio.

The CFTC has yet to provide full clarity on the legality of event-based contract trading. In the interim, Robinhood has been responsive and proactive, ultimately aiming to expand prediction market offerings while remaining fully compliant.

⚙️ How Robinhood works

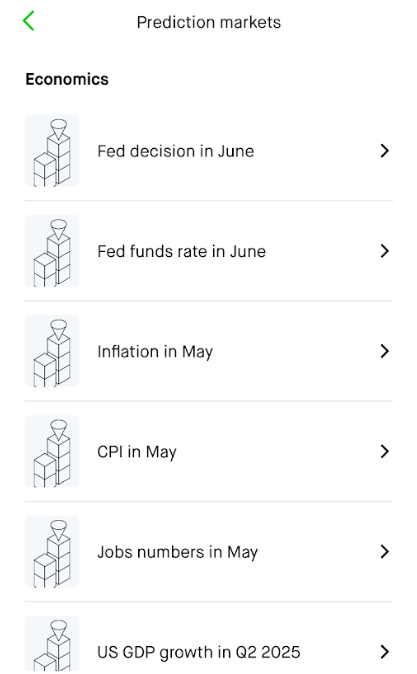

Robinhood’s prediction markets let users trade on the outcome of real-world events, such as sports results or economic decisions, using event contracts. Each contract is based on a clear future outcome. Here are some examples:

- Federal funds rate in June

- US GDP growth in Q2 2025

- NBA Eastern Conference Finals winner

- 2025 PGA Championship winner

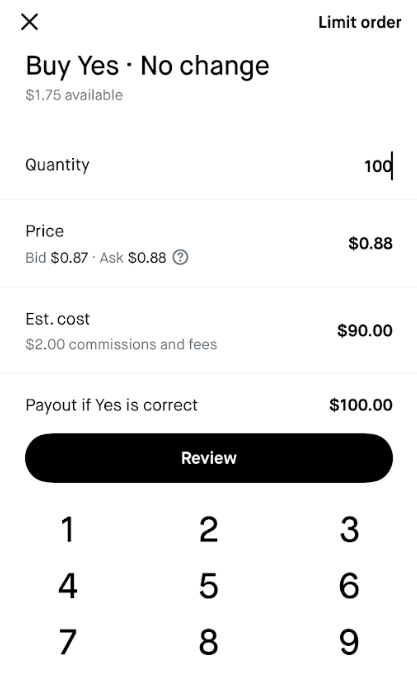

To participate in these markets, you buy a “Yes” or “No” contract. Prices typically range from $0.01 to $0.99 per contract. The price essentially reflects the market’s consensus probability. As an example:

- A contract is priced at $0.57 for “yes” and $0.43 for “no.”

- This implies a 57% chance for the outcome in question to occur, and a 43% likelihood of it not happening.

- When the event settles, winning contracts receive a payout of $1 each.

- The value for incorrect contracts is zero.

Robinhood charges a $0.01 commission per contract. Kalshi, the exchange, may embed an additional $0.01 fee into the contract price, making the total fee $0.02 per contract. For instance, if you buy 100 contracts, you’d pay $2 in total fees.

- You buy 100 “yes” contracts priced at $0.53, for a total of $53.

- The event resolves in your favor.

- Your contracts settle at $1, for a total of $100.

- Gross profit is $47, less fees of $2, for a net of $45.

Contracts settle instantly once the event resolves. In advance of resolution, markets remain active. You can enter and exit markets and close out contract positions by selling to another trader at an agreed-upon price.

For US users, Robinhood is a viable alternative to Kalshi. On fees, Kalshi gets a slight edge (max of $1.74 for 100 contracts vs. $2 for the same at Robinhood). Kalshi also provides a wider range of markets to trade, going beyond sports and economics with options such as cryptos, politics, and cultural events.

Polymarket also offers many more options by comparison. If you want to trade prediction markets on a user-friendly platform that also offers stocks, ETFs, options, and cryptocurrency trading, Robinhood is a great choice. For those who are seeking a much broader range of contracts to trade, check out Kalshi.

| Feature | Robinhood | Polymarket | PredictIt | Sportsbooks |

|---|---|---|---|---|

| Value score | High: Low fees, regulated, instant settlement | Medium: No US access, low fees, high liquidity | Low: High fees, limited markets, slow payout | Medium: Bonuses, but higher vig/fees |

| Market depth | High: Growing liquidity, especially on major events | High: Deep liquidity on global events | Low: Limited contract sizes, caps | High: Deep for popular sports, variable on props |

| Trading fees | $0.02 per contract | None | None | ~5-10% vig on bets |

| Profit fees | 1.75% fee (minimum of $1 and maximum of $150 per transaction) for instant withdrawals | Intermediaries may charge transaction fees for withdrawals. | 10% on profits, 5% withdrawal fee | None (fees embedded in odds) |

| Resolution method | CFTC-regulated, third-party sources (Kalshi) | Independent oracle, third-party sources | Market operator decision | Official league/event results |

| Tax reporting | 1099 forms provided for US users. | None (no US access) | Limited; typically no tax forms issued | 1099 forms provided for US users |

| Level of difficulty | Easy: App-based, intuitive interface | Medium: Crypto required, more technical | Easy: Web-based, simple interface | Easy: App/web-based, familiar to most users |

🎯 Markets available for trading

Robinhood offers trading of economic and sports event contracts. At this time, there are no other markets, such as political or cultural events. The table below has details on all of the contracts available for trading as of this writing, along with an example of pricing. On the downside, there’s no way to view trading volume or the number of positions held in a contract.

| Category | Market question | Example pricing |

|---|---|---|

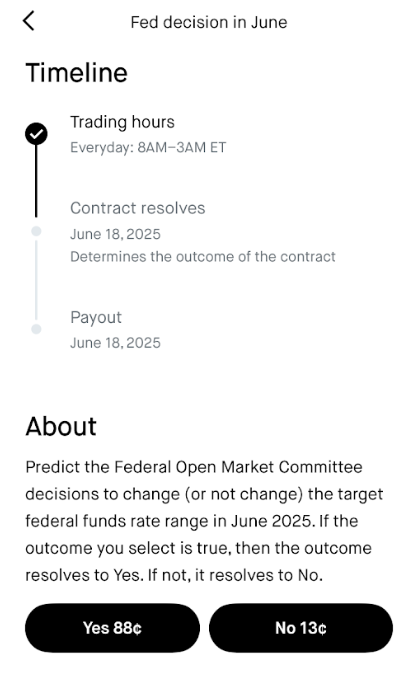

| 📈 Economics | Fed decision in June | -No change: Yes $0.88, No $0.13 |

| 📈 Economics | Federal funds rate in June | -Above 4.25%: Yes $0.88, No $0.12 |

| 📈 Economics | Inflation in May | -Above 2.4%: Yes $0.55, No $0.46 |

| 📈 Economics | CPI in May | -Above 0.1%: Yes $0.67, No $0.35 |

| 📈 Economics | Jobs numbers in May | -Above 100,000: Yes $0.69, No $0.33 |

| 📈 Economics | US GDP growth in Q2 2025 | -Above 0.5%: Yes $0.76, No $0.25 |

| 📈 Economics | Unemployment in May | -Above 4.2%: Yes $0.58, No $0.44 |

| 📈 Economics | US gas price in May | -Above $3.20: Yes $0.63, No $0.38 |

| 🏈 Sports | Men’s pro basketball championship | -Oklahoma City: Yes $0.44, No $0.57 |

| 🏈 Sports | Men’s pro basketball Eastern Conference Finals | -New York: Yes $0.45, No $0.56 |

| 🏈 Sports | Men’s pro basketball Western Conference Finals | -Oklahoma City: Yes $0.55, No $0.46 |

| 🏈 Sports | New York vs. Boston series winner | -New York: Yes $0.75, No $0.26 |

| 🏈 Sports | Denver vs. Oklahoma City series winner | -Oklahoma City: Yes $0.73, No $0.28 |

| 🏈 Sports | Men’s pro golf PGA Championship 2025 winner | -Scottie Scheffler: Yes $0.26, No $0.75 |

| 🏈 Sports | Men’s pro hockey championship | -Edmonton: Yes $0.27, No $0.74 |

| 🏈 Sports | Men’s pro hockey Eastern Conference Finals | -Carolina: Yes $0.50, No $0.52 |

| 🏈 Sports | Men’s pro hockey Western Conference Finals | -Edmonton: Yes $0.52, No $0.49 |

| 🏈 Sports | Florida vs. Toronto series winner | -Florida: Yes $0.87, No $0.15 |

| 🏈 Sports | Dallas vs. Winnipeg series winner | -Dallas: Yes $0.79, No $0.23 |

🔄 Buying and selling contracts at Robinhood

To trade event contracts, you’ll need an approved Robinhood Derivatives account. You must be a US citizen and have an open individual account with either “Margin investing enabled” or “Options trading approved (Level 2 or 3).”

If you’re a US user who doesn’t have all of those boxes checked, you can complete the process directly through the app. Log in to your account, search for “futures trading,” and then select continue to apply for a Robinhood Derivatives account and follow the instructions.

We followed those steps during our test run. From start to finish, we received approval for prediction market trading in just a few minutes. Once you’re approved, go to the investing menu on the app and scroll to the button labeled “trade event contracts.”

After you do that, you’ll be directed to the full menu of available prediction markets.

To view the specifics of a contract, just tap the name of what you want to explore.

If you scroll down your screen, you can view additional details about the contract, including when it will be resolved and paid out.

If you’re ready to trade, just click the “yes” or “no” button for your selection.

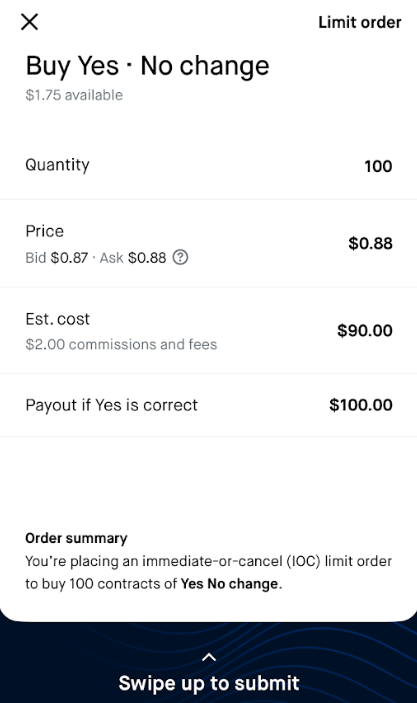

You’ll enter the number of contracts you want to buy, review the order, and then swipe up to submit.

Once you’re signed up and approved to trade prediction markets on Robinhood, it’s easy to begin trading. Moving forward, we’d like to see more details on the trading screen. For example, there’s currently no way for users to view contract trading volume, a data point that’s front and center on platforms such as Kalshi and Polymarket.

🔍 Robinhood vs. other prediction market apps

Here’s a closer look at how Robinhood stacks up when compared to other prediction market apps.

Robinhood vs. Polymarket:

- Robinhood is a fully regulated US platform offering prediction markets through its partnership with the CFTC-regulated exchange Kalshi. Trading is in USD, with tax reporting for trading activity.

- Polymarket is a decentralized, blockchain-based platform unavailable to US users. Global traders use cryptocurrency to trade on a wider range of markets.

- Robinhood focuses on compliance with regulations and accessibility via its user-friendly platform.

- Polymarket emphasizes decentralization and broader market variety but lacks formal regulatory oversight.

Robinhood vs. PredictIt:

- Robinhood is a fully regulated platform with broad market access and transparent fees of $0.02 per contract.

- PredictIt operates under a limited CFTC exemption, has strict trading caps, and charges fees for both deposits and withdrawals.

- Robinhood offers more markets for trading and is focused on widespread availability.

- PredictIt faces regulatory uncertainty and is mainly focused on trading US political contracts.

Robinhood vs. legal sportsbooks:

- Robinhood uses market-based pricing, letting users trade event contracts peer-to-peer. Trading is available for non-sports events.

- Legal sportsbooks offer fixed odds set by the house. The sole focus is sports, with outliers such as the Academy Awards available in a handful of states.

- Robinhood is open to all and operates in all 50 states, but it does not offer sports contracts in MD, NJ, and NV.

- Sports betting in at least some form is available in 38 states plus Washington, D.C. In eight of those markets, though, you can only wager in person.

| Feature | Robinhood | Polymarket | PredictIt | Sportsbooks |

|---|---|---|---|---|

| 🏆 Best for | US retail investors seeking regulated event trading. | Global traders who are familiar with crypto and are looking for decentralized markets. | Casual US traders, political research. | Sports bettors who are looking to wager on fixed odds. |

| ⚖️ Regulatory status | Fully CFTC-regulated via partnership with Kalshi. | Decentralized platform that’s unregulated in the US. | Operating under a limited CFTC exemption. | Regulated by individual states. |

| 💵 Minimum deposit | No minimum. | No minimum. | $10 minimum. | Varies by sportsbook, typically $5 to $10. |

| 💸 Payout/currency | USD | USDC stablecoin | USD | USD |

| 📍 Available in | All 50 states (no sports event contracts in MD, NJ, or NV) | Global (not available in the US) | US | 38 US states plus Washington, D.C. |

| 🎚️ Level of difficulty | Medium. User-friendly platform, but takes time to understand event trading. | Medium. An understanding of cryptos is helpful. Broad range of markets to choose from. | Easy. Web-based with limited markets. | Easy. There is an initial learning curve for those unfamiliar with sports wagering. |

What others are saying

While reviewing Robinhood, we checked out Trustpilot to see what users are saying. With 4,023 reviews to date, the commentary has not been favorable at all. Robinhood checks in with a 1.2 rating out of five stars, with 96% of reviewers giving it one star and just 2% giving it five. Common complaints include issues with customer service, accessibility, and withdrawals.

🏦 Robinhood deposit and withdrawal options

Robinhood has limited options for deposits and withdrawals: bank transfers and debit cards. There are no fees for either transaction, unless you request an instant withdrawal. In that case, you’re looking at a $1.75 fee (minimum of $1 and maximum of $150 per transaction).

All transactions are conducted in USD. Cryptocurrencies, eWallet options, and other methods are not available at this time. While options are limited, processing tends to be seamless. Robinhood is fully transparent, with no fees unless you request the instant withdrawal option.

| Method | Fee | Min. deposit | Withdrawal option |

|---|---|---|---|

| Standard Bank Transfer (ACH) | None | $0. (You need a minimum of $1 to place a trade.) | Yes |

| Instant Bank Transfer | No fees for deposits. (1.75% fee for withdrawals — minimum of $1 and maximum of $150 per transaction) | $0. (You need a minimum of $1 to place a trade.) | Yes |

| Debit Card | No fees for deposits. (1.75% fee if you request an instant withdrawal — minimum of $1 and maximum of $150 per transaction) | $0. (You need a minimum of $1 to place a trade.) | Yes |

📳 Robinhood customer support

There are several ways for users to get help from customer support at Robinhood.

| ☎ Phone: | No direct dial-in. You can request a callback through web or app support. |

| 📧 Email: | [email protected] |

| 🎧 Live chat: | Yes, 24/7 on app or website |

| 🗣️ Languages: | English primarily |

| 👥 Social: | Instagram, X, LinkedIn, Facebook, Instagram, Discord |

| 🏥 Help center: | Extensive article selection, FAQ section |

During our review, we came across multiple complaints about Robinhood customer service. The main gripes centered on wait times, overall helpfulness, and incomplete resolution of issues.

We tried out live chat for ourselves and had a much different experience. After getting through some brief questions with a bot (about 30 seconds total), we had the option to connect with a live agent.

After choosing that option, we were speaking to a live person in less than a minute. The representative was professional and helpful, answering all of our questions without issue or hesitation.

While we had a good experience, negative reviews tell us that others haven’t been as fortunate. Robinhood could improve feedback by offering direct dial-in phone support while working toward making lengthy wait times a non-issue.

🏆 Who is Robinhood best for?

Robinhood is well-suited for both hobbyist investors and active financial traders. Easy access, low fees, and a user-friendly platform make it ideal for those with limited experience. Active traders will find a streamlined experience that offers access to multiple markets from one intuitive platform. Meanwhile, “data nerds” will love advanced features like customizable layouts and access to real-time data.

It’s not the best fit for casual bettors, experienced gamblers, or those looking to wing it with speculation without understanding how the markets work. Robinhood’s focus is regulated financial markets and event contracts, not entertainment or pure speculative wagering. Those accustomed to betting in fixed-odds markets should be willing to tackle the learning curve that comes with contract pricing.

⭐️ Final rating: 4.2 out of 5.0

Robinhood is a regulated financial platform with protections in place for customer accounts and their balances. The company has firmly established itself as a leading online broker. There’s an abundance of trading markets, including stocks, ETFs, options, and cryptocurrencies.

The recent introduction of event contracts has generated even more interest in the platform. Robinhood is a solid choice for those who are interested in prediction markets. Our rating could rise in the future if it implements a few improvements.

- Additional markets. Only economic and sports contracts are available for now. We’d like to see more, including politics and cultural markets.

- Banking options. Bank transfers and debit cards cover most users. However, many prefer the flexibility of having a wider range of options.

- Customer service: We had a solid experience. However, the number of circulating complaints suggests there are more than isolated issues to address.

- Market data: Outside of the bars on the chart that indicate trends, there’s no way to dig further into the data, such as the total volume of trades of a specific event contract.

Prediction market trading is still in its infancy. Robinhood has established itself as an early leader and appears to be doing all that it can to address regulatory concerns and issues as they arise. For both new and experienced traders, it’s definitely worth your time.

Robinhood FAQs

Most users should view Robinhood as a tool for investing. There are no guarantees of income of any kind, let alone full-time earnings, due to market risk, volatility, and other factors.

Robinhood is a fully regulated and legitimate US brokerage platform. It provides tax documents for all reportable activity. Withdrawals can be processed to linked bank accounts or debit cards, with standard transfers free and instant withdrawals incurring a small fee.

Limit orders let you set a specific price for buying or selling. You can cancel a pending limit order anytime before it executes through the app or website. Once the order is executed, it cannot be canceled or edited.

You can set up recurring orders for stocks, ETFs, and crypto through the Robinhood website and app. There’s also an option to automatically invest a portion of each paycheck with direct deposit. At this time, there is no automation for prediction market trading.

Robinhood is available in all 50 US states. However, certain features or products may be restricted or limited in specific states due to local regulations or current litigation. For example, sports event contracts are not currently available for trading in MD, NJ, and NV.

Robinhood uses market-based pricing for sports event contracts. Prices are set by supply and demand among users, not by an in-house bookmaker or outside service. As such, contract pricing differs from the fixed odds you will see at top online sportsbooks.

On Robinhood, you trade prediction market event contracts with other users in an open market. It’s similar to trading on other exchanges, such as those tied to commodities or other financial instruments. Prediction market trading differs from wagering at a sportsbook, as you’re not trying to “beat the house” or betting on fixed odds.